- Millennials are turning to investing in equities and cryptocurrencies to build wealth as they face spiralling house prices and uncertain futures

- Financial influencers on social media, or ‘finfluencers’, are emerging to provide questionable investment advice to vulnerable investors

- Traditional investor relations companies are trying new tactics to bring together finfluencers, ASX companies and millennial investors — potentially targeting vulnerable investors with unlicensed advice — amid growing concerns from the regulator ASIC

After paying a major economic price for COVID-19-induced restrictions, Millennials and Gen-Z are turning to investing in equities and cryptocurrencies to generate wealth.

At the same time, financial influencers — or ‘finfluencers’ — are gaining popularity among these young investors on social media platforms such as Instagram and TikTok.

And now the world of financial public relations has brought the two together in the form of “MarketLit”, an online event that claimed to be “Australia’s First Millenial and Gen Z investment conference”. It was created and promoted by The Capital Network (TCN), a boutique investor and media relations agency.

Source: The Capital Network

A fast growing and vulnerable market

There are now more than nine million Australians holding investments outside their homes, and another 900,000 Australians say they want to invest but haven’t started yet, according to recent ASX data.

In 2020, more than 435,000 investors placed their first trade on the ASX, with almost half these investors aged between 25 and 39, and 18 per cent under 25.

This raised concerns that recent market entrants “have been engaged in short-term speculation rather than long-term wealth creation”, the ASX said, acknowledging the market volatility over the past 16 months.

ASIC’s concerns about “finfluencers” and new investors

The Australian Securities and Investments Commission (ASIC) raised concerns about this speculative type of trading in March this year, alongside a warning to new investors about the sources of their financial advice.

Greg Yanco, ASIC’s Executive Director, Markets, said while everyone was entitled to take risks, the regulator recommended having long-term goals over making rash decisions, especially for first time investors.

“We also recommend learning about trading before you start or getting advice from someone you trust,” Mr Yanco said.

ASIC chairman Joe Longo said last month at a parliamentary committee hearing that social media influencers giving financial advice was an “area of big concern” for the agency.

The growth of conferences to target this vulnerable market

During the COVID pandemic the investor conference circuit in Australia was hit hard. However with the innovation of Zoom, many investor relations and event companies quickly adapted to “Virtual Conferences” or roadshows as a new way for listed companies to reach investors.

The Capital Network claims it is Australia’s “Premier investor relations business” and typically promotes its small-cap ASX clients to investors via various media channels.

Last Friday The Capital Network launched Australia’s first Millennial Investor Conference, MarketLit. The event, primarily targeting Women and Millennial investors, featured dozens of listed companies and finfluencers.

Source: The Capital Network

The Capital Network co-founder and event organiser Lelde Smits has admitted that of the mostly small-cap stocks at the event — nine of them miners — 40 per cent were clients of her firm.

This is something Emma Rapaport of leading investor research firm Morningstar said should have been made far clearer.

“I can see no evidence of disclosure in the promotional materials or the event organiser’s website,” said Ms Rapaport, who is Morningstar Australasia’s editorial manager.

“This is a clear instance of a public relations firm using a conference to promote its clients.”

Ms Smits said the event was “not for profit” and presenting companies did not pay to be included in the conference program, though some ASX companies contacted by The Market Herald have confirmed they did pay to present. The Capital Network said this was to cover the costs of production of the pre-recorded segments that most presenters provided.

Research by The Market Herald shows that at least some of the finfluencers at the MarketLit conference were either holders of ASX stock or were compensated for their promotion, though this may have been unknown to The Capital Network, the event organisers. The Capital Network said when questioned “Every market expert and financial influencer was asked to only discuss personal experience, not provide financial advice”.

ASX Companies falling for finfluencers

On the growth of this sector, Sarah Lenard, Managing Partner of strategic consultancy Advisir (part of The Market Herald Group) expressed concerns for investors and that some ASX-listed companies may get caught in the crossfire.

“Of our 200 plus listed clients we’ve seen an alarming increase over the past six months in the number of listed companies in Australia and North America seeking our advice after being approached by finfluencers, PR firms or brokers,” Ms Lenard said.

“It’s unfortunate that many companies are being led to believe that building ‘advocacy’ with these types of finfluencers is the right way to engage with investors.”

Ms Lenard also outlined the challenge that listed companies have when considering the use of finfluencers and social media as part of their investor relations strategy.

“If you’re the MD or CEO of a publicly listed company, there’s a myriad of options when it comes to investor events and with no real way to effectively measure ROI, navigating which events are going to present the best value can be tricky. Often we see listed companies, and in turn their shareholders, spend money on finfluencers without fully understanding the long term impacts.”

The quality of finfluencer advice

But what kind of advice do finfluencers provide and what are their qualifications to help others?

The finfluencer model is well established – a combination of aspirational quotes, common sense and curated social media. Often the representation of women is challenging, playing to well-worn stereotypes driven by a need to drive social media attention.

Among the finfluencers lined up with the Aussie small caps at the Marketlit conference was US-based Amy Marietta (@amy_marietta).

Source: Instagram

Her Instagram page — with around 177,000 followers — is a blend of tips on cryptocurrency, self-help, fashion and travel blogging.

Of her experience, she says: “After five years of hustling in New York City, and one year in Miami working corporate marketing & social media, I now spend most of my time in LA or travelling.”

There is no disclosure of any possible payments, and a direct message to Amy about whether she accepted payment for the products she promotes has gone unanswered.

Source: Instagram

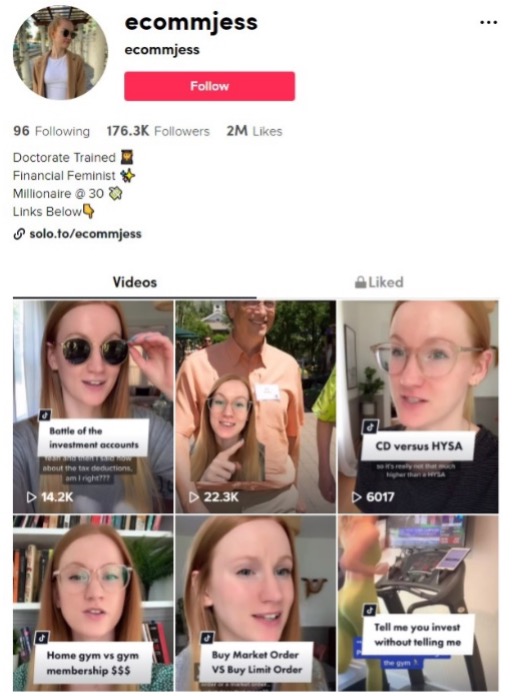

Also from the US is finfluencer @ecommjess, a “doctorate trained financial feminist” who offers budgeting advice and money saving tips, including how some wedding expenses can be tax deductable.

Source: Instagram

While this might be true in the US, the Australian Taxation Office (ATO) website makes it clear that these are not a deductable expense in this country.

She also disclaims that none of what she offers should be taken as financial advice.

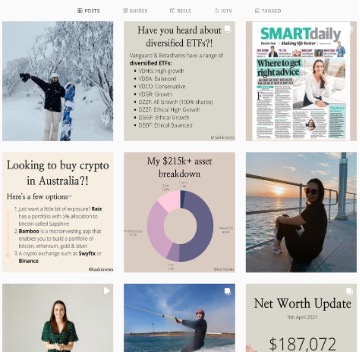

With more than 80,000 followers on TikTok and 27,000 followers on Instagram, 23-year-old @tashinvests was one of the headlining finfluencers for the event. Her Instagram bio explains how her goal is to share how she saves, invests and builds her net worth — which she states is currently $190,000.

She also has a list of affiliate links to online brokers, shopping sites, budgeting services and online banks from which her followers can get rewards for signing up using her link. This could suggest she receives some form of commission from purchases, but this is not stated one way or the other.

Tashinvests admits to having worked for at least three of these affiliate services — Up Bank, WeMoney, and Pearler.

Her finance and investment tips typically come between inspirational posts about trips and activities around Australia.

The regulatory position of finfluencer advice

In Australia, anyone giving financial advice must have an Australian Financial Services Licence (AFSL).

To become a finfluencer, on the other hand, requires no specific expertise.

Additionally, Ms Rapaport said, investors needed to understand the risks associated with investing in small-caps.

“The audiences that finfluencers bring to the conference will likely be newer investors, many of whom have never experienced a long, painful market downturn,” she said ahead of the conference.

“They are just beginning to form views on risk tolerance, coached by online personalities about the benefits of index-investing and diversification. Sure, you might get lucky on a stock pick, but what if it goes the other way?”

Dante De Gori, CEO of the Financial Planning Association of Australia (FPA), said the frameworks set up for monitoring and policing advertising and finfluencers’ advice appeared “increasingly unfit for purpose”.

Finfluencers are operating in a legally grey area

Legal advice The Market Herald obtained from top tier law firm Clayton Utz states that anyone giving financial product advice in Australia must have an Australian Financial Services Licence (AFSL). This includes the finfluencers who presented at the event organised by The Capital Network.

Financial product advice is defined by the Corporations Act 2001 as a recommendation or statement of opinion intended to influence a person’s decision-making about a particular financial product, or class of financial products. It can also be statements that could reasonably be regarded as being intended to have such an influence.

Factual information, which can be easily verified, does not constitute financial product advice and people sharing it do not require an AFSL.

But the regulatory landscape relating to social media finfluencers is rapidly evolving.

At a Parliamentary Joint Committee hearing last month, ASIC Commissioner Danielle Press indicated that product advice provided by social media influencers is considered a key issue and is at the forefront of the regulator’s agenda.

On the question of finfluencers accepting “kickbacks” or commissions to promote specific financial products, Ms Press said this would be a “key issue” for those providing financial advice as a business, which the payment of commissions or ‘kickbacks’ would suggest.

Failure to obtain an AFSL when required can attract fines of up to $133,200 for an individual. The maximum fine for an individual making false or misleading representations on social media, per breach, is $500,000.

This would be more than the entire net wealth of many of the finfluencers who presented at the event who disclosed their financial position.

On this issue, Australian Consumer Law states that advertising cannot mislead or deceive consumers, and this extends to social media influencers with commercial arrangements.

Moreover, as best practice, social media influencers should disclose paid promotions of financial products or classes of financial products. However, this would also suggest they are carrying on a business to provide financial product advice. This means many of the finfluencers who presented at The Capital Network’s event are operating in a legally grey area at best.

A one-line disclaimer from the agent or carrier service stating “Not Financial Advice” does not necessarily excuse the provider from complying with the financial services licensing regime.

Australian Shareholders Association at the event

Against this regulatory backdrop, Australian Shareholders Association (ASA) CEO John Cowling was one of the speakers at the conference. However, when questioned, an ASA spokeswoman said the association had not formally endorsed the conference.

The spokeswoman added that the association was all for “education and people applying critical thinking” to their investments.

The Capital Network director and conference organiser Lelde Smits is also a director of the ASA.

The ASA says that as Australia’s largest, independent individual investor association it educates investors and “stands up for shareholder rights”. However a review of the ASA advertising materials suggests it has only a few thousand members out of millions of Australian retail share investors.

Why does all this matter?

The stock market is currently as speculative as it has ever been, and with more and more inexperienced investors joining the ranks, many are looking for spikes and sudden bounces without considering the consequences of getting it wrong.

Sharing investment tips and strategies is important. What’s even more important is knowing how to filter the valuable opinions from the noise.

Finfluencers can make sometimes complex products seem appealingly simple. The trouble is that the financial expertise some of them hold is skimpy. And few appear to provide advice in a way that would be in line with the current licensing regime.

As Federal Minister for Financial Services and the Digital Economy Jane Hume said last month: “The TikTok influencer spruiking Nokia is not that different to the bloke down at the pub who wants to tell you all about the really great company he just invested in — but with a much louder voice.”

It’s also a voice that’s aimed at some of Australia’s youngest and most vulnerable investors.