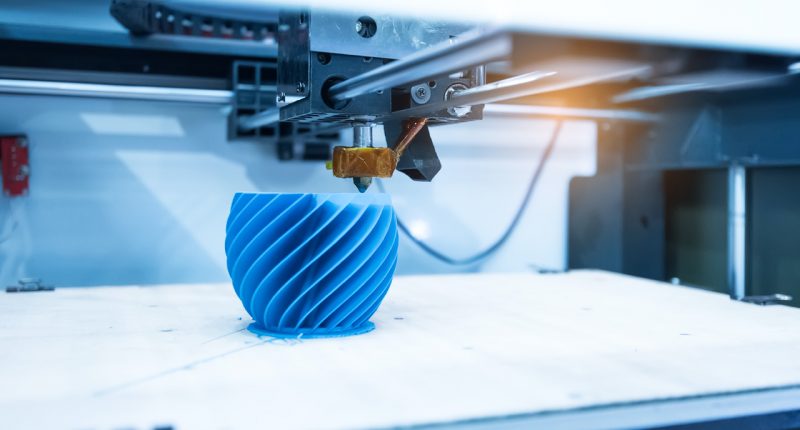

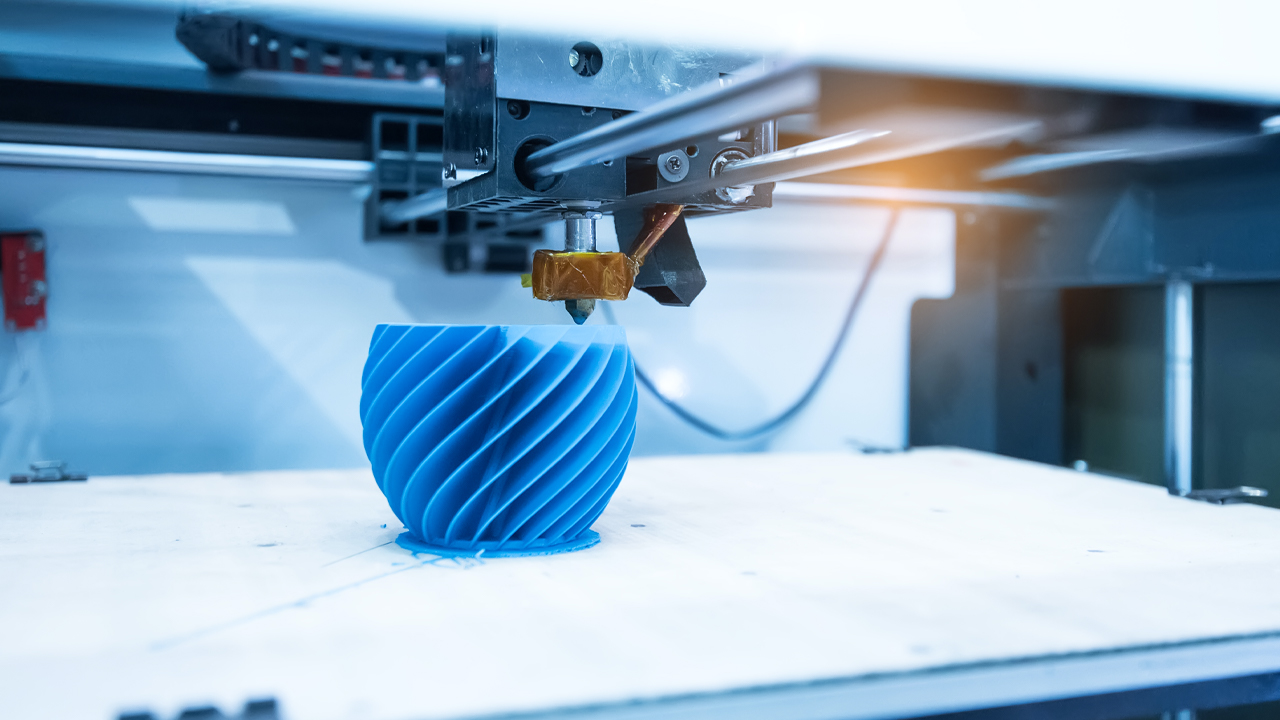

- Metal 3D printing company Aurora Labs (ASX:A3D) says it is in talks with some big businesses for its RMP-1 product

- Should evaluation and testing of RMP-1 prove successful, these companies might buy the product

- However, no potential clients were named and details regarding the negotiations were vague

- Aurora seems to be playing things on the safe side to make sure it doesn’t mislead the market

- Aurora’s share price has dipped 3.7 per cent today, with shares priced at 26 cents each

Metal 3D printing company Aurora Labs has released a somewhat ambiguous announcement to the market today regarding business negotiations.

The company said several “leading global manufacturers” are in talks with Aurora about its RMP-1 metal 3D printer.

The company said in the event some evaluating and testing of the product proves successful, these companies have expressed an interest in buying the RMP-1.

However, that’s about as much detail as investors were given.

While the list of global manufacturers includes a European automotive manufacturer, a Japanese industrial corporation, an East Europe-based steel manufacturer, and a U.S. printing company, no names were given about the potential clients.

Of course, Aurora is likely just being cautious about jumping the gun and potentially misleading the market. Particularly in light of iSignthis’ battle with the Australian Securities Exchange, Aurora is playing things on the safe side.

Managing Director David Budge said with conversations like these, the pathway to revenue for the RMP-1 is on its way to becoming a reality.

“In my view, there is genuine excitement at the performance of the RMP-1, which is leading the world in speed, output size and product quality,” David said.

“We expect to conclude commercial arrangements to undertake the sample test production program soon and look forward to keeping the market informed of developments,” he added.

In an unusual move, Aurora’s announcement included a warning to investors that these negotiations have not yet resulted in any contracts, so caution should be exercised when making investment decisions.

Yet, despite Aurora’s refreshing transparency, the market seems to be after something more substantial.

Aurora’s share price has dipped 3.7 per cent over today’s trading session, with shares priced at 26 cents each at 2:03 pm AEDT.