- The explosion of buy now, pay later (BNPL) services is bringing with it an avalanche of debt that people have no idea how to manage

- However, lending and debt collection are two sides of the same coin — meaning as debt rises, so does the need for effective debt management

- The current debt collection space is plagued with a reputation of uncaring and aggressive business practices, but ASX-listed Credit Intelligence (CI1) is changing that

- Through its recent purchase of Australian fintech group Yozo, Credit Intelligence is collaborating with the University of Technology, Sydney (UTS) to revolutionise the financial management industry for small and medium enterprises (SMEs)

- The enhanced Yozo platform will provide business health checks, analytics, and effective expense management for SMEs

- On top of this, Yozo will provide ethical BNPL services to SMEs with personalised repayment schedules

- Importantly, all of these services will be powered by artificial intelligence

- At 3.3 cents per share with a $47.31 million market cap, Credit Intelligence is highly undervalued — presenting a unique opportunity for shrewd investors to buy in before the business takes off

The explosion of buy now, pay later (BNPL) services in recent years has opened up a wave of opportunities for investors and consumers alike as the availability of low-cost credit soars.

The issue is that as millennials are taking on these small liabilities in droves, they seem oblivious to the mountain of debt growing in front of them.

This means on the other side of the buy now, pay later boom is an avalanche of debt that people have no idea how to manage — and the services that are causing this upcoming crisis appear to have no intention of stopping any time soon.

The Australian Securities and Investments Commission (ASIC) has already raised concerns about how recklessly BNPL services like Afterpay (APT) are being used — especially in light of the COVID-19 pandemic — and has flagged potential upcoming regulation to the sector. But it might be too little, too late.

This means the biggest beneficiaries of the BNPL crisis will be debt managers who can help people manage their finances and hold on to their dignity.

ASX-listed Credit Intelligence (CI1) has already positioned itself nicely to tackle this oncoming age of new debt. But there’s one key factor that differentiates CI1 from its peers in the debt management space: ethics.

A new age of ethical debt management

There are hundreds of ASX-listed companies in the business of lending, with new competitors in the BNPL space constantly popping up. Yet, lending and debt collection are two sides of the same coin, and there are only a handful of stocks operating in the debt collection space.

What’s more, this space is plagued with a reputation for being aggressive and uncaring to the point where customers are alienated from financial institutions chasing down arrears.

Credit Intelligence identified this issue and is now breaking the mold with its ethical and moral approach to the debt management space, which is all made possible through the use of artificial intelligence.

In fact, with the recent purchase of Australian fintech specialist Yozo, Credit Intelligence is gearing up to disrupt the financial management space as we know it.

High-profile collaboration

Yozo’s tech was developed in collaboration with Professor Guandong Xu, a Professor in Data Science and leader of the Artificial Intelligence (AI) Institute at the University of Technology, Sydney (UTS).

With a focus on small and medium enterprises (SMEs), the tech uses AI and machine learning to personalise and streamline loans while also making sure the business knows exactly what it’s getting itself into when it takes on new debt.

Now, Credit Intelligence is enhancing this tech to create a one-stop-shop for all finance needs for SMEs.

Importantly, CI1 and Yozo are once more teaming up with UTS to develop the new tech features.

The fact that an organisation of UTS’ reputation and calibre is joining forces with a small-cap listed business like Credit Intelligence is a strong validation of the existing technology and the vision behind the Yozo platform.

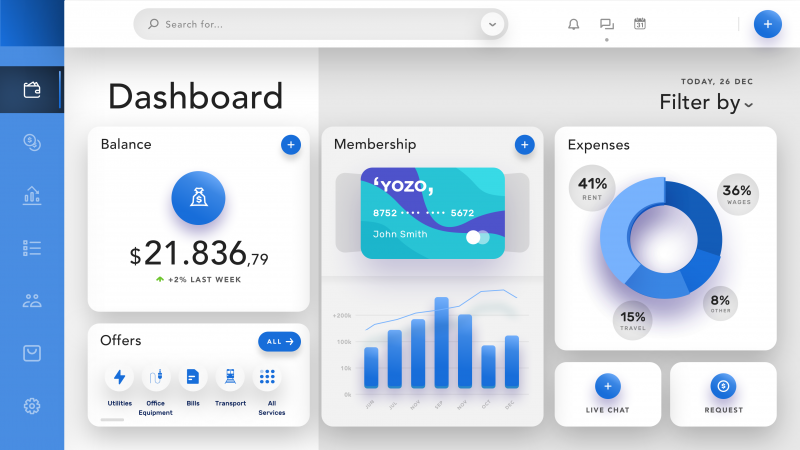

Source: Credit Intelligence

UTS clearly believes there is something unique about the AI-driven Yozo service.

Yozo Co-Founder Sunny Zhu said the tech was born out of a desire to help small businesses.

“Not every SME needs funding, but they do need support in other ways,” Sunny said.

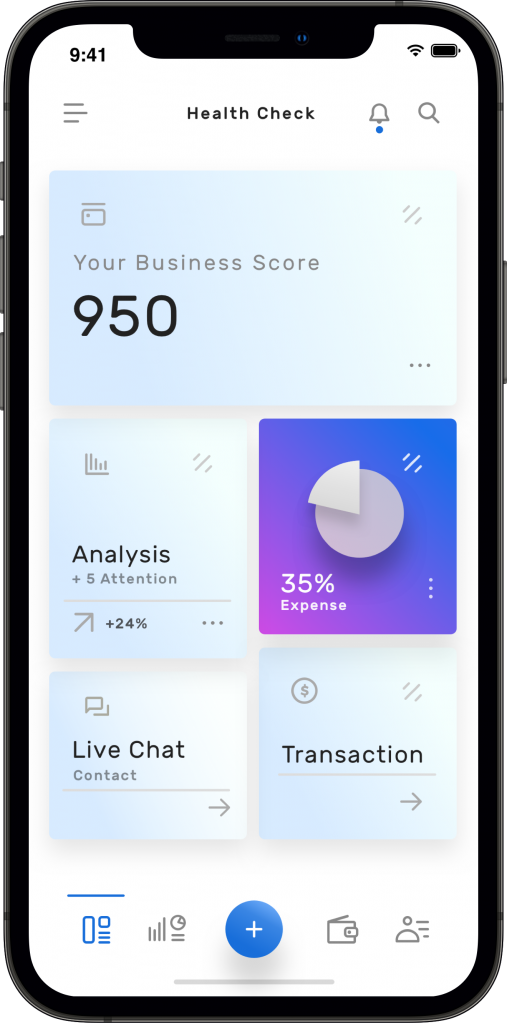

Essentially, the AI-based platform can connect to a business’ electronic banking services and accounting software to analyse all facets of an SME, automatically learning payment schedules and spending trends.

The platform then provides in-depth financial analytics and business health checks to help small businesses minimise their expenses and maximise their repayment potential.

What does Yozo offer?

Yozo is already an established leader in SME lending and financing. But the enhanced features of the AI-based technology will make the business so much more than this.

Source: Credit Intelligence

The automatic Yozo health checks will allow SMEs to easily track important financial information through a user-friendly centralised dashboard.

Yozo will also use the learnt payment schedules and spending trends of the business to provide alerts and advice to SME customers, all through AI.

Yet, the tech goes beyond simple financial management; Yozo’s platform works 24/7 in the background of a smartphone or tablet to find the best deals on frustrating but necessary business expenses.

From insurance deals to supply costs to electricity and gas bills, the enhanced Yozo tech will able to automatically find businesses the best available deals and notify them when new and better deals become available

What’s more, the deals are fully personalised for each individual business — meaning the tech does more than just scan the web for good prices.

Instead, the Yozo platform can do all the work necessary to find best-fit deals for SMEs. Take electricity, for example: instead of a busy business owner needing to call different providers, explain their position, hand over their info, and then wait for a response, Yozo does handles the whole process automatically and notifies the SME when a better deal becomes accessible.

Source: Credit Intelligence

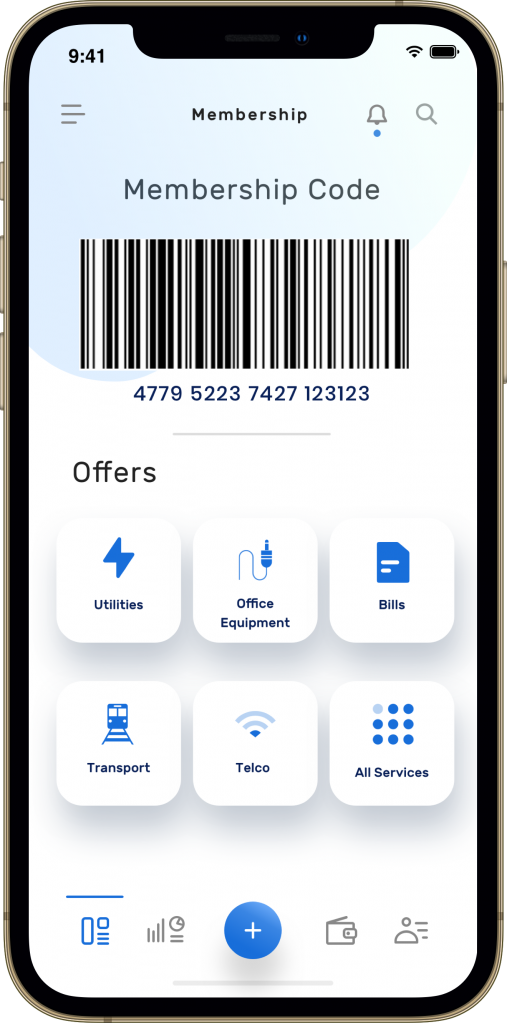

On top of this, Yozo plans to work with other industry partners, meaning users have the chance to secure even better prices through specific Yozo partner deals.

Yet, while Yozo will continue to provide the intelligent loan services that attracted CI1 to the business in the first place, the company is set to provide a new service for SMEs with the help of UTS: buy now, pay later.

BNPL without the guilt

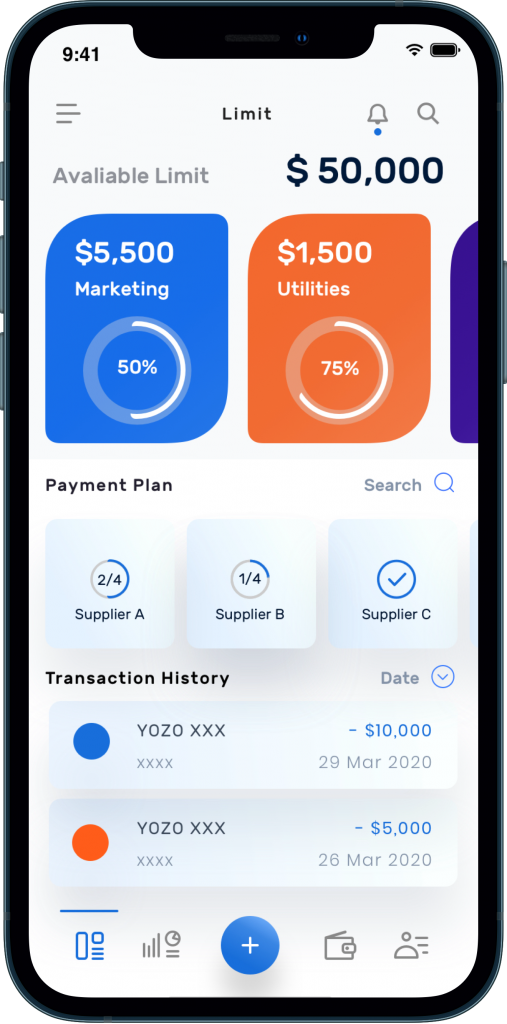

By taking advantage of Yozo’s AI-driven technology, small businesses can enjoy personalised repayment schedules on their loans and BNPL transactions to ensure they are not biting off more than they can chew.

“We understand one size does not fit all and every business/industry is different,” Sunny said.

“The AI system will analyse and recommend the tailor-made solution for the SME to choose from,” he said.

He explained that the Yozo platform will automatically assess not only how much money is coming into a business, but when the business banks its receipts.

A restaurant, for example, might have new money flowing into the business every day as customers pay for immediate service. An SME offering design services, on the other hand, might only receive full payment once a product has been delivered — meaning it could see weeks between major receipts.

Source: Credit Intelligence

A loan for each of these businesses will need to look very different. Through the Yozo platform, a personalised repayment system will be offered to each business based on their specific business analytics.

This means SMEs can have all the benefit of low-cost credit without unwittingly taking on more debt than they can bear.

It also means ethical investors have access to a BNPL service that doesn’t survive on the financial struggle of others.

In contrast to the typical SME lending industry, the Yozo system actually helps SMEs, rather than leaving them high-and-dry in return for a decent commission.

Helping SMEs while turning a profit

Credit Intelligence has already proven itself to be a profitable business with a keen eye for spotting gaps in the market.

With the company well-placed to benefit off the carnage being created by the buy now, pay later sector, Credit Intelligence’s Yozo developments mark the next step to finding ways to help embattled businesses and turn a profit while doing so.

At the same time, the importance of AI in the debt management market is starting to come to light.

With AI in the picture, customers can have immediate peace-of-mind that their repayment plans are best-suited to their specific situation, while debt collectors are free to focus on ensuring the debtor holds on to their control and their dignity.

A 2018 report from multi-billion-dollar consultancy firm Tata Consultancy Services found AI has the potential to revolutionise the debt management market as we know it.

“[Artificial intelligence] could well prove to be a godsend for banks looking for non-intrusive methods of communication with delinquent customers and bring them back into the mainstream,” the report said.

“AI-powered solutions can potentially transform the way collections are handled and ultimately help banks to improve customer experience and create exponential value”

So, at 3 cents per share with a $39.22 million market cap, Credit Intelligence is highly undervalued — presenting a unique opportunity for shrewd investors to buy in before the business takes off.